You might have heard a lot of people talking about stock market. But still not clear about what is stock market? And How does it work? This blog explains the basics of stock market for beginners in a very simple way. Benjamin Franklin said-“An investment in knowledge pays the best interest.” So, let’s grab knowledge first and then make money through stock market trading.

Basics of stock market for beginners

What is a stock?

A stock is a common term which can be described as the ownership certificate of any company.

What is share?

A share refers to stock certificate of a company which means you get proportionate ownership according to number of shares you are holding. Holding a share makes you the shareholder of the company.

What is the stock market?

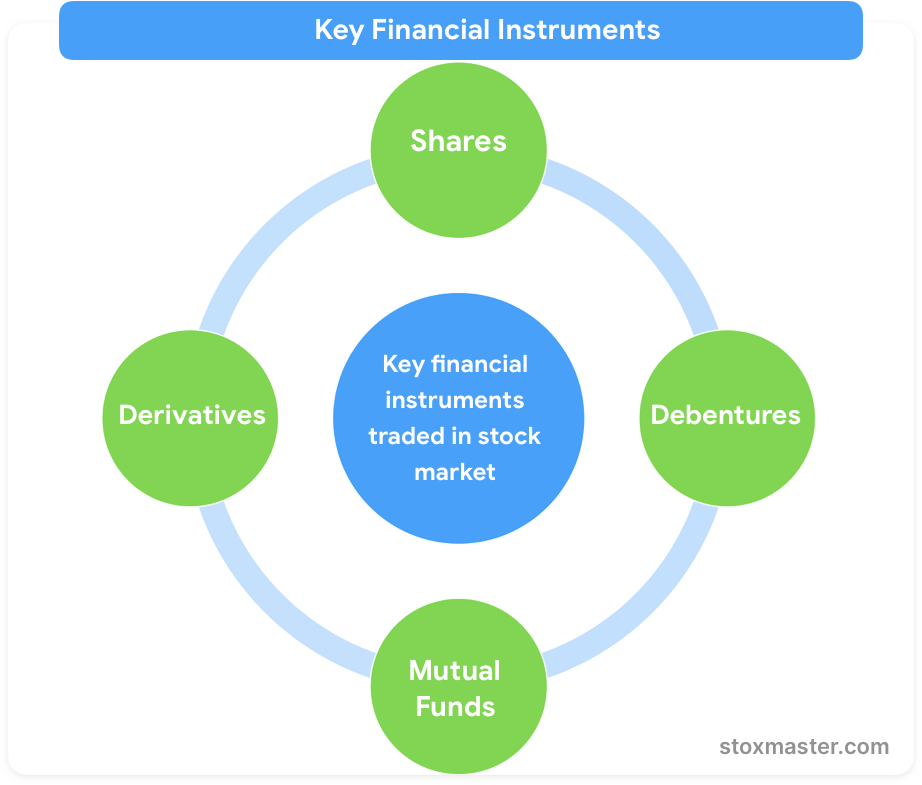

A stock market is a platform where buyers and sellers come together to buy financial instruments in the form of shares, debentures, bonds, mutual funds, etc.

What is the basic working of the stock market?-Every beginner should know

It is important that every beginner must understand the basic working of the stock market before entering the stock market.

There is a new cloth manufacturing company which is planning to raise funds through the stock market. First of all, the company is new so it will have to advertise itself through advertisements and other mediums of marketing. If the investors like the idea they will sponsor the company by buying the shares through the process of IPO (Initial Public Offering). When the investors will buy the shares, they will become the partial owners of the company with ownership limited to the shares held by them. You need to have a Demat account to invest in IPO.

When the company grows and makes profits, more investors are interested in buying the shares of the company. If demand increases, then the price of acquiring the share increases. The rise in the value of the shares results in increasing the value of the company and thus fund new initiatives. If the company seems to turn unprofitable, then the investors fear that they might face loss and they might panic. As a result, they start selling their shares to reduce their losses before the company loses more value. So as demand for the stock goes down, the price of the share decreases.

The price of the share is also dependent on many other factors

- Economic situation of the country

- Fluctuating prices of raw materials

- Updates in the taxation rules and regulations

- Changes in laws of a particular sector

- New developments in production technology

- Cost of labor

What are the basic two types of stock market every beginner should know?

Primary Market

Secondary Market

After IPO is released, the bought shares are sold between the buyers and sellers in the secondary market. However, the company has no role in this buying and selling of shares.

Key financial instruments traded in the stock market

Important basics terminologies of the stock market

Ask Price or Offer Price

The stock market is like any other commercial market. So, the traders can buy and sell shares according to their convenience. Ask price or offer price refers to the monetary value at which you’re willing to sell shares or stocks of a particular company. Thus, this ask price or offer price could be prefixed or negotiable.

A buyer might be willing to pay a very high price (called bid price) for the shares (much more than your asking price) if he or she feels that their value may rise soon. Thus, the variance in values of ‘ask’ and ‘bid’ gives rise to another term-‘spread’.

After-hours transactions

Stock markets throughout the world open and close at fixed times. However, it may not always be possible for you to trade while the official business hours. Nevertheless, you can still transact beyond the scheduled hours but your transaction will be recorded in the subsequent working day. Hence, this type of transactions are called after-hour transactions

Annual report

A company, especially during the end or beginning of a financial year conducts the annual general meeting. So they have to present the annual report contains a myriad of information ranging from investments, earnings, profit/loss, and so on. Thus on the basis of the annual report, the present shareholders take significant decisions.

Assets

Assets include materials, goods, and equipment owned by a company as well as other tangible and intangible items like cash, land, buildings, trademarks, and copyrights.

Balance Sheet

The balance sheet reflects the company’s liabilities and assets outlined in the form of a statement. The assets are usually listed on the left side of the sheet while the liabilities appear on the right.

Bear Market & Bull market

When the prices of the majority of stocks reflect a downward trend, it results in the bearish market. In contrast, when the prices of the majority of the stock reflect an upward trend, it results in the bullish market.

Blue-Chip Shares/Stocks

There are premium chips used in gambling dens and casinos. Likewise, there are stocks embody stocks of financially well-off companies and conglomerates. As a result, they are called blue-chip shares or stocks.

Bonds

The promissory notes brought out by the government and public limited companies specify a particular amount held by the purchaser for a prescribed period are called bond. Thus, bonds tend to be as stable and exchangeable as legal tender.

Call Option

As the terminology indicates, call option offers the trader or investor the choice of purchasing stock at a predetermined price within a certain period. This is optional. Hence, the trader is under no obligation to exercise the option.

Commodities

Commodities usually include natural resources and agricultural-based products. As a result, they need to be traded separately on a distinct platform which is called commodity trading.

Learn how to invest in the stock market as a beginner in our next blog

Finally, we hope you like our article on Basics of Stock Market for Beginners very helpful. Please subscribe to our newsletter and never miss the opportunity to get the article directly to your inbox. Learn from StoxMaster – Stock Market Training Academy and get trained to trade. You can also learn for Free from our Free YouTube Videos .