What is intraday trading?

Intraday trading is a trading practice in which buying and selling of stocks takes place within the same trading day. The stocks are purchased and sold on the same day with an intention to make profits. So, the intraday trader takes advantage of the fluctuations in the stock price. You need a trading account to do intraday trading.

Intraday trading is considered one of the most lucrative career options in the stock market. But you need to understand the basic terminologies of day trading and strategies related to it.

Basics of intraday trading

Annual report

An annual report is a comprehensive report which shows the financial situation of the company.

Arbitrage

Arbitrage is the process of buying and selling the same security in different markets at different price points.

Bear Market

Bear market is the market situation in which the price movement of all the stocks is going down due to increased selling pressure. As a result, you should buy in this market situation because of low prices.

Bull Market

Bull market is the market situation in which the price movement of all the stocks is going up due to increasing buying pressure. As a result, you should sell in this market situation because of high prices.

Blue-chip stocks

Blue-chip stocks are the stocks of large scale and well-organized companies with a history of strong financial performance. Read more.

Bid

Bid is the amount a trader is willing to pay for the share of a given stock.

Open Position

Open position is the investing position in which the trader has established or entered the trade and is yet to close with an opposing trade. It is following a buy, a long position, a sell or a short position.

Close Position

Close position is the investing position which refers to executing a security transaction which is the opposite of the open position.

Execution

Execution is when an order to buy or sell has been completed. If you have ordered to sell 50 shares and that 50 shares have been sold.

Index

Index is the benchmark point which is used as a reference marker for traders and portfolio. The stock market index measures the stock market or subset of the stock market which helps investors in comparing the current price levels with past price levels. It measures the stock market performance.

Low

Low is the lowest price point in which a stock or index reaches than previous price point.

High

High is the highest price point in which a stock or index reaches than previous price point.

Margin

Margin is the account facility that allows the borrower to take a loan from a broker to make an investment. It is the difference between the amount of loan and the prie of security you wish to buy.

Moving average

Moving average is a stock’s average per share during a particular period of time which can be monthly, quarterly, yearly, etc.

Order

Order is the buy order or sell order executed at stock market prices. The certainty of execution is higher than the price of execution.

Thus, these were the basic terminologies of the intraday trading which every trader should know.

Let us understand intraday trading strategies in the next topic.

Intraday trading strategies

The traders make use of technical analysis for intraday trading. Technical analysis helps in making correct decisions. One important tool of intraday trading is the candlestick chart patterns. The candlestick chart patterns track the price movement of stocks every minute, hour, month, quarter, year. There are some common intraday strategies which are as follows:

- Scalping, which attempts to capitalize on minute price movements in the stock market. It is a popular strategy in the forex market. But this strategy is profitable if you buy in quantity. Though it is very risky.

- Range trading is a strategy through which a trader identifies the oversold and overbought areas. The trader buys in the oversold area(support level) and sells in the overbought area(resistance level). This helps the trader to “buy low, sell high”

- News-based trading, focuses on taking advantage of trading opportunities which focuses on increased volatility around news events.

- High-frequency trading (HFT) makes use of sophisticated algorithms to take advantage of small or short-term market inefficiencies. It combines different types of arbitrage in formulating the strategies.

So, the above intraday strategies are some of the popular strategies used by intraday traders.

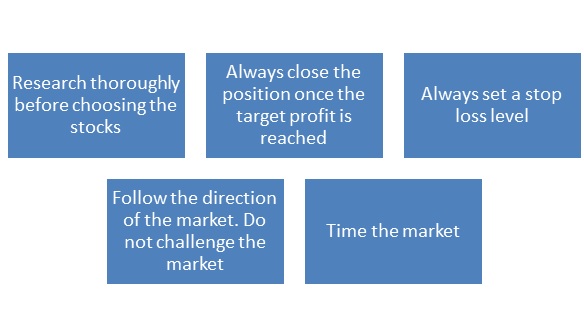

Intraday trading tips

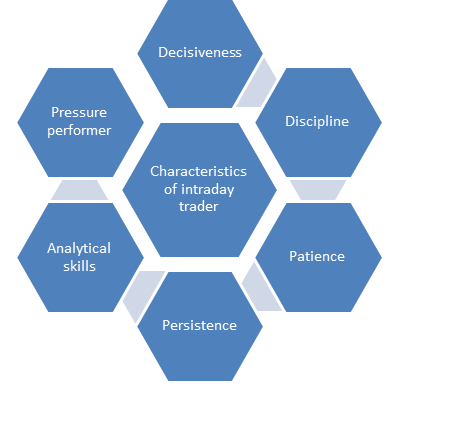

Characteristics of intraday trader

Intraday trading as a profession

Intraday trading is an attractive career option for many people. People may consider it for part-time income or full-time income. You don’t need an educational degree to become an intraday trader. Then, you might be wondering what do we need?

You need 3 P’s- Passion, Patience and Persistence to become a successful intraday trader. If you have the passion to understand the volatility of the stock market, patience to analyze the price movement of the stocks and persistence to stay in spite of losses. Then the stock market is the perfect place for you.

If you are a beginner and you can start by investing in the IPO. Read more about IPO in our next blog.

Finally, we hope you like our article on Intraday Trading very helpful. Please subscribe to our newsletter and never miss the opportunity to get the article directly to your inbox. Learn from StoxMaster – Stock Market Training Academy and get trained to trade. You can also learn for Free from our Free YouTube Videos .