The coronavirus impact has triggered panic among global investors and has already caused the stock market to hit lower circuit twice in the month of the March. The IMF has already declared that we are have entered into global recession which will affect the emerging markets and developing economies most. Thus, the impact of the coronavirus outbreak on the stock market in India will result in huge losses.

Let us under understand the impact of coronavirus on the stock market in India and on a global level in this article

” There’s no magic drug out there : What the people in charge are saying about coronavirus “

Impact of Coronavirus

Impact Of Coronavirus On Global Markets

All global financial markets are down and it can attribute to many factors, but the main factor which is causing the stock market to go down is the Coronavirus outbreak. After the outbreak of coronavirus in China, it has spread to almost 202 countries and cost many economies on a large scale.

The major stock markets like FTSE, Dow Jones and Nikkei have seen the huge falls since the COVID-19 outbreak began on 31 December, 2019. This was caused due to the fear among the investors that the overall economy is going to suffer huge losses. As a result, the central bank in many countries has decreased the interest rates to lower the burden on the people amid the financial crisis.

8 Ways in which coronavirus could impact the stock market in India

Coronavirus Impact & Decline in Oil Prices

The coronavirus outbreak has been officially declared a pandemic. Following this, an odd timed global crude oil war has begun. The OPEC has demanded to further restrict the production from April which has been rejected by Russia. Increasing production during low demand will result in a bad position in the oil market. But this could be a blessing in disguise for India. It will give relative benefit to India because it is one of the largest importer of oil. Oil prices have a significant impact on stock market prices.

Domestic Mutual fund flows

There is a significant percentage of increase in mutual fund investments. According to the data on the Association of Mutual Funds in India, the MF industry registered total SIP inflows of Rs. 8,518.47 crore in December, a growth of 3 percent over November and six percent growth year-on-year. The growth is mutual fund investments is likely to impact the stock market positively

India’s GDP slow growth rate

The Indian economy is facing a severe slowdown in the growth rate. In the quarter ending in September 2019, the GDP growth rate dropped to a whooping rate of only 4.5%. The coronavirus outbreak has adversely impacted the global supply chains and thus impacting global market indices. In February, the Moody has projected a 5.4% real GDP growth rate for India in 2020. This is a downgrade from previous estimate of 6.6%.

Falling yields on 10 Year US Treasury bonds

The outspread of coronavirus is causing economic fallout. To combat this problem, the FED reserve decided to slash interest rates to zero percentage point. The 10-year Treasury yield broke below 1% for the first-ever due to the interest rate cut. The economic growth in the US and around would decelerate quickly which will impact the stock market in India.

Imports of Chinese Goods

The sectors in which India is dependent on China- Electronics, Pharmaceutical, Chemicals, Solar, etc. is likely to face serious issues in the supply chain. The import-export chain is likely to affected badly. The statistics show that the Chinese goods accounted for 13.7% of the country’s imports. And, 5.1% of the India exports went to China.

Loose Monetary Policy

India is already facing economic slowdown issues due to loose monetary policies. Budget 2020 wasn’t able to address and solve those major issues. The coronavirus outbreak is likely to cause a global economic slowdown which would further lead to an economic slowdown.

Rising number of coronavirus cases in India

As on 1st April 2020, 1751 coronavirus cases have been reported and 53 people are deceased. The market scenario could get serious if the number of cases increases. The stock market has already hit the lower circuit twice in the month of March. India’s Heath and development infrastructure do not possess the capability to handle the coronavirus outbreak at a large level.

Issues in specific sectors

The NBFC and Real Estate sector are facing pressing issues that are causing a huge impact on the stock market in India. NBFC sector is squeezing due to growing NPA’s and the real estate sector has many unfinished projects, project on hold due to non-clearance, unsold apartments which is causing a slowdown in the growth. Despite negative factors, there are opportunities in which India can deal with the coronavirus outbreak.

But, we will not recommend you to blindly invest in the stock market. We suggest you invest your time in training which will help you in doing profitable trades in the stock market.

Thus, the above factors suggest how coronavirus outbreak is likely to impact the stock market in India.

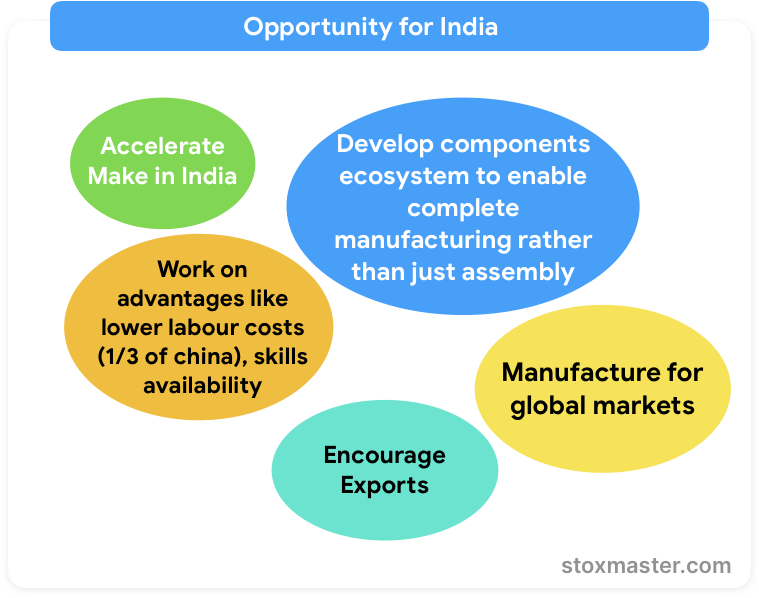

Opportunities for India

The following image shows the opportunities that lie for India amid the coronavirus outbreak

You might be interested in investing in the stock market and want to know how to analyze stocks. Check out our blog on Fundamental analysis and Technical analysis.

Finally we hope you like our article on Impact of Coronavirus on Stock Market in India very helpful. Please subscribe to our newsletter and never miss the opportunity to get the article directly to your inbox. Learn from StoxMaster – Stock Market Training Academy and get trained to trade. You can also learn for Free from our Free YouTube Videos .